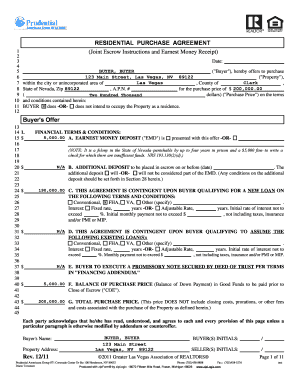

Get the free nevada real estate purchase agreement

Show details

STANDARD RESIDENTIAL PURCHASE AGREEMENT STATE OF NEVADA DEFINITIONS BROKER includes cooper ating br oker s and all sales per sons. DAYS means calendar days midnight to midnight unless other wise specified* BUSINESS DAY excludes Satur days Sundays and legal holidays. DATE OF ACCEPTANCE means the date Seller accepts the offer or the Buyer accepts the counter offer. DELIVERED means per sonally deliver ed tr ansmitted by facsimile machine by a nationally r ecognized over night cour ier or by fir...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nevada residential purchase agreement form

Edit your nevada purchase agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is the nevada residential protection throughout the transaction process form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing residential purchase agreement online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nevada residential purchase agreement pdf form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out the information that must be such as inspections or appraisals

How to fill out Nevada residential purchase agreement:

01

Gather all necessary information: Before filling out the Nevada residential purchase agreement, make sure to collect all the essential information such as the buyer's and seller's names, property address, purchase price, financing terms, and any additional conditions or contingencies.

02

Review the agreement form: Carefully read through the Nevada residential purchase agreement form to familiarize yourself with its sections and requirements. Take note of any specific clauses or disclosures that may be unique to Nevada real estate transactions.

03

Complete the basic information: Start by filling out the basic information section of the agreement, including the names of the buyer and seller, their respective addresses, and contact details.

04

Specify the property details: Provide a detailed description of the property being purchased, including the complete address, legal description, and any other relevant details.

05

Define the purchase price and financing terms: Clearly state the agreed purchase price of the property and indicate the form of payment, whether it is cash, financing, or a combination of both. If financing is involved, specify the loan terms, including the down payment amount, interest rate, and loan term.

06

Include any contingencies: If there are any contingencies or conditions that must be satisfied before the transaction can proceed, such as a satisfactory home inspection or mortgage approval, clearly outline them in the agreement.

07

Disclosures and additional provisions: Ensure that all necessary disclosures required by Nevada law are properly included in the agreement. Additionally, you may add any additional provisions or conditions that both parties have agreed upon, such as repair or maintenance agreements, closing date, or prorations of expenses.

08

Sign and date the agreement: Once all the relevant sections are completed, both the buyer and seller should sign and date the agreement. It is advisable to have the signatures notarized for added legal validity.

09

Keep copies for all parties: Make sure to keep copies of the fully executed Nevada residential purchase agreement for all parties involved, including the buyer, seller, and any real estate agents or attorneys involved in the transaction.

Who needs Nevada residential purchase agreement?

The Nevada residential purchase agreement is necessary for anyone involved in a residential real estate transaction in Nevada. This includes both buyers and sellers of residential properties, whether it is a single-family home, condominium, townhouse, or other types of residential properties. Real estate agents, brokers, and attorneys representing the buyer or seller may also need the Nevada residential purchase agreement to facilitate and document the transaction effectively.

Fill

a residential purchase agreement in financing arrangements and other conditions

: Try Risk Free

People Also Ask about blank purchase agreement

How do I write a bill of sale in Nevada?

FAQ: About the Nevada Bill of Sale Date of purchase. Contact information of buyer and seller. Purchase amount. Description of the sold item. Guarantee that the asset is cleared of any liens or claims. Ongoing terms, such as warranties. Signatures of buyer and seller. Signature of a notary public.

Does Nevada require a bill of sale?

Yes, a bill of sale is required for private car sales in Nevada. Form VP104 needs to be completed and signed by both the buyer and the seller.

Where must the original copy of the Louisiana Residential agreement to Buy or Sell be delivered once it's accepted?

The original of this agreement must be delivered to the listing broker's firm. However, any additional addendums or other changes will all be considered one with the agreement.

What is a bill of sale for personal property in Nevada?

A Nevada general bill of sale is a document that is typically utilized between private parties to prove the legal sale and purchase of personal property occurred. The form provides complete information with regard to the selling and purchasing parties as well as the property itself.

How do I file a complaint against a property manager in Nevada?

File a Complaint Complete a Statement of Fact Form 514. Complete a Statement of Fact Form 514c. Complete a Statement of Fact Form 514d. Provide a complete and detailed sworn statement of your complaint. Name all parties present during conversations or actions.

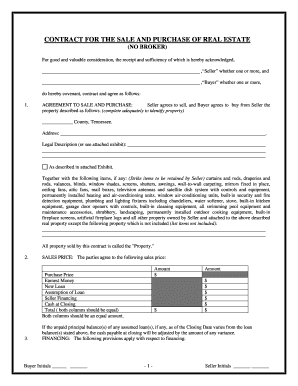

How do you document purchase agreements?

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pandadoc for real estate contracts review to be eSigned by others?

Once you are ready to share your to ensure the accuracy of is essential for future reference, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my blank real estate purchase agreement in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your residential purchase agreement nevada directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out the who needs nevada residential purchase and document the transaction effectively form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign real estate purchase contract template and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is residential purchase agreement nevada?

A residential purchase agreement in Nevada is a legally binding contract between a buyer and a seller for the purchase of residential real estate. It outlines the terms of the sale, including the purchase price, financing arrangements, and other conditions.

Who is required to file residential purchase agreement nevada?

Both the buyer and seller are required to execute the residential purchase agreement. It is typically filed by the real estate agent on behalf of the buyer or seller with the appropriate governing bodies.

How to fill out residential purchase agreement nevada?

To fill out a residential purchase agreement in Nevada, you need to provide details such as the property address, sale price, buyer and seller information, terms of financing, contingencies, and closing details. It's advisable to consult a real estate professional to ensure accuracy.

What is the purpose of residential purchase agreement nevada?

The purpose of a residential purchase agreement in Nevada is to clearly delineate the expectations and obligations of both the buyer and seller, providing a framework for the sale process and ensuring that both parties are protected.

What information must be reported on residential purchase agreement nevada?

The information that must be reported on a residential purchase agreement in Nevada includes the property description, purchase price, earnest money deposit, closing date, financing terms, and any contingencies such as inspections or appraisals.

Fill out your nevada real estate purchase online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Simple Real Estate Purchase Agreement Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to realtor purchase agreement form

Related to nevada real estate forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.